Capital Gainlux:

Understanding Digital Asset Market Structure Through Capital Gainlux AI Intelligence

Sign up now

Sign up now

Capital Gainlux applies advanced intelligence to observe crypto market behavior as it unfolds in real time. Instead of relying solely on surface level price movement, the system examines interaction density directional strength and movement sequencing to identify early structural formation.

To maintain analytical consistency, Capital Gainlux processes incoming market data through adaptive learning systems before presenting insights. This approach reduces sensitivity to short lived volatility and keeps focus on signals that support sustained market alignment and directional continuity.

When pressure builds or directional transition begins to emerge, Capital Gainlux categorizes these conditions through layered analytical models. Continuous monitoring supports measured interpretation during shifting environments, and cryptocurrency markets are highly volatile and losses may occur.

Instead of waiting for confirmation after movement completes, Capital Gainlux tracks behavioral shifts as they form. Variations in momentum, liquidity reaction, and order engagement are evaluated live and organized into structured analytical context. Reduced dependence on past cycles keeps attention centered on current market forces, supporting clarity during unstable conditions.

Rather than responding solely to visible price disruption, Capital Gainlux examines instability at the behavioral level. Pressure build up, imbalance progression, and intensity variation are assessed to transform disorder into structured intelligence. Each insight delivers timing context and structural relevance to support disciplined interpretation.

During dynamic conditions, Capital Gainlux recalibrates by analyzing participation shifts, reaction depth, and multi layer confirmation logic. Broad market data is condensed into actionable insight without depending on delayed indicators. Only verified analytical outputs are provided, reflecting authentic live market conditions.

Capital Gainlux applies engineered models that stay flexible across different analytical approaches while maintaining structural consistency. The platform does not execute trades and functions purely as an intelligence provider. Each framework incorporates verified data, adjustable analytical layers, and continuous pattern monitoring to support rational evaluation and informed insight.

Capital Gainlux operates within a secured analytical environment, where all information processing is safeguarded with layered encryption and controlled access. Since trade execution is not part of the system, financial assets and private account credentials are never handled. Ongoing governance ensures reliability, minimizes unnecessary data retention, and preserves operational integrity.

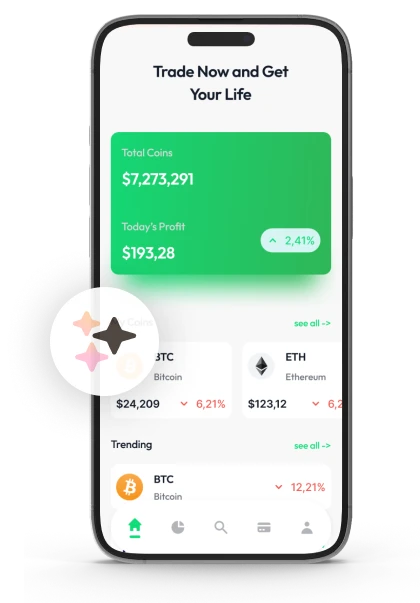

Capital Gainlux presents market movements through a systematic visual structure that emphasizes critical price regions, directional trends, and phase shifts. All graphics are produced using data driven algorithms rather than interpretive assumptions. This method enables objective evaluation, comparative analysis, and consistent observation without emotional distortion.

Capital Gainlux monitors ongoing price interaction instead of relying solely on historical patterns. Developing directional force is tracked from inception and recorded precisely. Insights focus on current market activity rather than lingering effects from prior trading periods.

Market complexity is converted into organized intelligence that focuses on underlying structure rather than surface movement. Analytical results stay connected to live conditions, allowing changes in momentum and participation to be observed with clarity and balance. Signal processing is designed to reduce delay effects, remove excess noise, and support steady evaluation for informed trading decisions.

Capital Gainlux maintains dynamic alignment as market behavior develops over time. Shifts in strength liquidity expansion and breakout formation are examined live without dependence on fixed reference points. Analysis remains anchored to active conditions and current participation patterns.

Instead of releasing unprocessed indicators, Capital Gainlux verifies inputs through structured momentum assessment logic. Refined filtering removes irrelevant activity so authentic directional movement becomes clearly visible. Cryptocurrency markets are highly volatile and losses may occur.

As balance begins to shift, Capital Gainlux detects emerging volume trends directional clarity and pressure buildup immediately. Ongoing observation ensures interpretation stays relevant accurate and usable during changing phases.

Capital Gainlux is structured to support efficient interaction through adaptive controls simple navigation and an uncluttered interface. Insight access and configuration remain smooth to help maintain consistent analytical attention.

Capital Gainlux studies developing market pressure by examining participation flow reaction timing and directional progression in detail. Rather than condensing findings into minimal signals the platform presents a clear visual explanation of how market structure forms as activity increases.

Live data streams are arranged into multi level momentum frameworks that help maintain clarity during sudden or uneven price movement. This approach supports balanced interpretation and situational awareness when conditions shift rapidly.

For dependable insight consistency Capital Gainlux operates within secured analytical systems supported by active monitoring processes. Data handling remains stable so insights reflect real time behavior while structured assessment is maintained.

Capital Gainlux determines emerging directional bias by coordinating several independent verification layers including pressure evaluation confirmation thresholds activity structure mapping and depth adaptive review. Insight is made available only when defined criteria align which supports dependable interpretation and limits analytical ambiguity.

Directional behavior is examined through an ordered assessment process that considers speed change directional persistence and repeated activation together. Once dominant pressure factors synchronize minor fluctuation is filtered out leaving confirmed structural context for accurate market evaluation.

Capital Gainlux identifies developing condition changes before movement becomes visually obvious. Subtle rhythm shifts pressure redistribution and balance variation are detected early supporting alignment with live development rather than delayed signal reaction.

Capital Gainlux adjusts analytical responsiveness to accommodate different evaluation horizons. Short cycle observation receives fast structured response while longer duration analysis is supported with steady balanced insight suitable for extended review.

Through organized flow interpretation Capital Gainlux highlights where directional force begins where stabilization forms and where rotational potential may appear. Each phase is weighted logically to support preparation systematic review and actionable clarity.

Capital Gainlux assesses multiple projected outcome paths concurrently aligning anticipated behavior with predefined analytical structures. Direction resilience response consistency and pressure concentration are reviewed together to strengthen insight reliability over time.

Capital Gainlux converts live price behavior into clearly defined analytical zones using spatial modeling paired with momentum focused evaluation. Instead of overcrowding the visual field the system isolates areas where continuation or reversal probability builds allowing targeted assessment.

The visual layout illustrates how directional energy distribution changes over time. Compression development rotational behavior and structural weakening are observed collectively to determine whether conviction is increasing or diminishing.

To maintain interpretive precision Capital Gainlux presents only elements that demonstrate ongoing analytical relevance. Visual output adapts to real time rhythm variation while internal prioritization continuously reassesses importance supporting disciplined evaluation.

Rapid reaction cycles amplified narratives and emotional intensity can distort timing accuracy. Capital Gainlux mitigates this effect by measuring participation density sentiment speed and response velocity across multiple behavioral layers aligning emotion with active price movement.

Sentiment patterns are monitored across short and extended observation windows to capture early psychological reversal. Change rate and intensity are analyzed together revealing emerging confidence erosion beneath visible action.

By integrating behavioral sentiment with directional pressure analysis Capital Gainlux delivers a balanced interpretive model. When psychological signals diverge from structural evidence alerts encourage reassessment supporting disciplined review.

Digital asset markets often respond to shifting global economic factors. Changes in inflation trajectory employment trends or growth outlook can redirect capital behavior. Capital Gainlux tracks these variables through an integrated macro context layer assessing timing relevance and scale before translating them into structured insight.

Advanced analytical logic connects broader economic movement with active crypto price behavior. By comparing historical macro transition phases with current structural alignment Capital Gainlux highlights scenarios where external influence reinforces developing price action.

Capital Gainlux combines automated evaluation with structured rule logic to deliver precise interpretation of crypto market behavior. The monitoring framework reviews directional alignment liquidity distribution and fragmented activity identifying irregular development as it forms.

Analytical focus adjusts dynamically to emphasize the most relevant live conditions. Price behavior is evaluated within complete contextual structure rather than as isolated movement ensuring insight reflects true market organization. The interface remains clear transparent and fully user directed.

Minor structural imbalance often appears before larger directional progression. Capital Gainlux links subtle tempo variation with historical volatility response to generate early guidance supporting organized preparation instead of impulsive reaction.

Sudden acceleration can emerge unexpectedly. Capital Gainlux identifies these conditions as they develop defining reaction zones and delivering concise scenario context. Each alert outlines initiation scale and short term relevance while execution control remains external.

Through continuous structural monitoring Capital Gainlux highlights early directional formation and surfaces actionable configurations prior to broad participation. Pressure buildup directional agreement and potential inflection areas are mapped to support anticipation.

Fast transitions can challenge planning yet Capital Gainlux delivers stable structured feedback throughout volatile phases. Standardized evaluation and motion analysis activate alerts only when behavior confirms supporting measured response.

Capital Gainlux integrates advanced analytical systems with practical assessment logic to interpret price behavior identify stress within order activity and surface reliable response zones. Ongoing monitoring of sentiment flow volume change and momentum alignment builds directional awareness while execution remains external.

The insight framework updates continuously to preserve clarity during sharp expansion or sudden reversal. In fast moving crypto environments structured reasoning supports disciplined strategy development and controlled evaluation.

Capital Gainlux organizes rapidly changing market information into clear analytical context using AI driven visualization structured assessment and strategic reference tools. Insight delivery remains independent of execution since the platform does not connect with trading accounts.

Capital Gainlux introduces functionality through a guided learning progression that supports smooth onboarding. Early interaction emphasizes clarity and logical navigation while advanced capabilities such as scenario modeling and performance review become available with continued use.

No. Capital Gainlux does not perform trade execution. The platform supplies insight related to opportunity identification timing evaluation and broader market structure while all execution decisions remain solely with the user.

| 🤖 Registration Fee | Zero cost to register |

| 💰 Administrative Fees | Fee-free service |

| 📋 Enrollment Ease | Simple, quick setup |

| 📊 Study Focus | Insights into Digital Currencies, Forex, and Investment Funds |

| 🌎 Country Availability | Available in nearly every country except the US |